The temptations of deferred removals

Carbon dioxide removals must start at scale sooner than people think

THE realisation that carbon-dioxide removal (CDR) had been seriously neglected, say many of those in the field, dates back roughly five years: it was a reaction to a provision of the Paris agreement of 2015 which took a few years to sink in.

Developed countries wanted the Paris agreement to set a limit on global warming of no more than 2°C above the pre-industrial temperature. Some developing countries, particularly those on small islands, wanted a more stringent limit: “1.5 to stay alive”, as the hallway chant had it. The final compromise strengthened the main goal to “well below 2°C” and advocated “pursuing efforts” towards 1.5°C.

To sweeten things for the 1.5°C brigade, the agreement also asked the Intergovernmental Panel on Climate Change to go and work out how much better the lower target would be. The IPCC reported back three years later: it would be a great deal better—but also much harder. One set of figures jumped out from its report: the four “pathways” found to offer a good chance of 1.5°C foresaw the removal of between 100bn and 1trn tonnes of carbon dioxide from the atmosphere before 2100. Those numbers saw CDR go “from a completely niche, academic, propeller-headed discussion to central policymaking,” says Julio Friedmann of Carbon Direct, a carbon-management company.

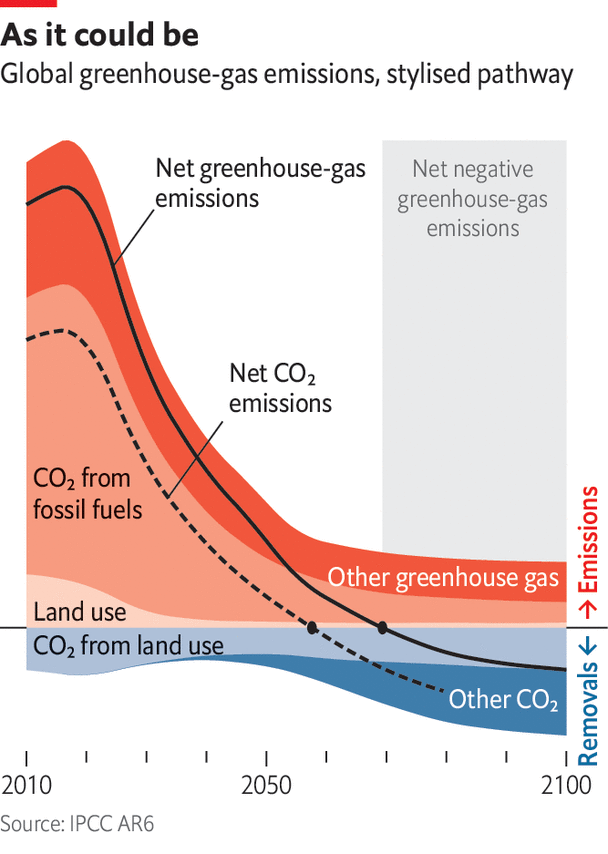

The trillion-tonne pathway in that 2018 report was particularly arresting. It was the only one based on the assumption, subsequently proved correct, that carbon-dioxide emissions would not peak before the mid-2020s. According to the models used to produce such pathways, that late a peak meant there was no longer any chance of getting to net zero in time to have a 50:50 chance of staying below 1.5°C. Instead the pathway showed an “overshoot” trajectory in which, after the temperature broke the 1.5°C barrier, it was brought back down by “net-negative” emissions which significantly reduced the amount of carbon dioxide in the atmosphere. That required heroic levels of CDR: as much as 20bn tonnes a year.

Pathways or slippery slopes?

The requirements for a 2°C limit are not so insanely demanding. Indeed, at the time of the Paris agreement, it was still just about possible to imagine that it might be achieved with very little CDR, should emissions start dropping immediately. Instead, though, they rose; in the eight intervening years the world has emitted 300bn tonnes of carbon dioxide, more than the United States emitted over the entire course of the 20th century. Even if, when emissions do start to fall, they fall considerably faster than was envisaged in 2015, the world will still need a fair bit of CDR.

This is a good example of an aspect of CDR which is particularly disturbing. The possibility of removals allows climate policy to take the form of a deal similar to that which St Augustine asked of God: “Oh, Lord, make me chaste and celibate—but not yet.” The possibility of marginally more CDR tomorrow is too easily taken, in the world of scenarios and pathways, as licence to reduce emissions marginally more slowly today. The peak isn’t coming soon enough? The reductions aren’t steep enough? Clean it up later!

For 1.5°C this planetary procrastination has run its course; when you are talking about both breakneck emissions-reduction and a trillion tonnes of CDR, the game is clearly up. For 2°C it is a work in progress. Currently, pathways offering a decent chance of stabilisation at 2°C require an additional 1bn-13bn tonnes of CDR a year by 2050. The longer emissions stay high before their eventual fall, the bigger that number will get.

In a world where every delay in emissions reduction was accompanied by compensating investments in CDR designed to make sure the technology would be available at the appropriate scale by the time it was needed, that temporal trade-off might make some sort of sense. This is not that world. It is, instead, a world with significant experience of imagined future solutions which, in practice, prolong the status quo.

The technology of carbon capture and storage is a pertinent example. In the early 2000s people imagined that taking carbon dioxide from the smokestacks of power stations and industrial plants and burying it might be a large part of the response to climate change. Many in the fossil-fuel industry were keen to foster an idea which appeared to offer them a future. Despite some progress, it remains, 20 years on, largely a technology of tomorrow. That experience is one of the reasons some fear the same will be true of CDR. (The two approaches, while similar in some ways, are conceptually quite distinct. Carbon capture and storage is a way of greatly reducing the emissions from burning fossil fuels; CDR is a way of reducing the level of carbon dioxide in the atmosphere.)

The scale of what needs to be done if CDR is to be a useful part of climate action, rather than an excuse for inaction, is vast. “The State of Carbon Dioxide Removal”, a report published by an international team of academics earlier this year, shows that there is a lot of carbon dioxide being stored by managed forestry and some more as a result of industrial biomass use, mostly as a by-product of ethanol fermentation. But the more radical technologies being focused on for durable storage today hardly register. Added together they come up to less than 1m tonnes: a megatonne. The burden put on them in net-zero plans requires them to work at a scale a thousand times larger: that of the gigatonne.

A gigatonne (Gt) is not a measure that is easy to grasp. It is the weight of 3,000 Empire State Buildings: enough to put one on each block of Manhattan and still have a good few left to scatter over the other boroughs. It is half again as much as the weight of all the world’s livestock.

There are, remarkably, some human activities that already move things around by the gigatonne. The 4trn cubic metres of natural gas the world uses each year weighs about 3Gt; the oil fix comes in at 5Gt. Such figures suggest that capturing and storing carbon dioxide by the gigatonne is a plausible thing for the world economy to do. But it also suggests that it will require a huge industry devoted to doing something for which, today, people are unwilling to pay.

If the scale of the eventual endeavour is not quite unprecedented but still daunting, so is the challenge of creating an appropriately sized industry in just a couple of decades. It is hardly commonplace, but the challenge posed by the climate crisis has already seen the world do just such a thing. In 2000 worldwide solar-power capacity was about a gigawatt. Today the total has three more zeroes—a terawatt. Solar companies and projects attracted $350bn of investment in 2022, according to Jenny Chase of BloombergNEF, a data company.

Ain’t no sunshine...

But the solar industry had two advantages. One was really large subsidies early on: between 2004 and 2012 Germany alone spent over €200bn ($270bn) on the deployment of solar panels. The other was that the boom was centred on scaling up a single already-understood industrial process—turning semiconducting silicon into photovoltaic cells. Doing something a lot makes it cheaper, a phenomenon that is captured in what management textbooks call an experience curve. Solar’s experience curve has seen cells become 20-30% cheaper for every doubling of installed capacity.

The situation for CDR is far less promising. Governments are not supporting the technology anything like as much as they did solar. A recent report by the Boston Consulting Group (BCG) calculated that $1.7bn was invested in “durable” CDR last year, where durable normally means that the carbon dioxide ends up underground as a stable mineral, or tucked away in depleted oil- and gasfields, or dissolved in aquifers the water from which is never used. The authors reckon that is about 10% of what solar was getting at a comparable stage in its development.

And CDR will probably not benefit from experience curves to the same extent that solar did. Processes which involve dealing with straightforward things in bulk, often out in the field, are much less easily cheapened than the mass production of semiconductors in factories.

What is more, there is an increasingly bewildering range of CDR technologies on offer. Some will doubtless fall by the wayside. But few in the field expect a single technology to become dominant in the way that silicon photovoltaics have. This is in some ways a good thing—different technologies will allow different sorts of application in different situations. But doubling the installed capacity of each of ten separate technologies just once gets you much less by way of savings than doubling the installed capacity of one technology ten times in a row.

And some sort of cheapening is vital. Today’s gold standard in CDR is direct-air capture, or DAC: large banks of fans are used to pull air through machines which strip it of its carbon dioxide through a chemical-engineering process before storing it away. Two companies dominate the field: Carbon Engineering, a Canadian startup which Occidental Petroleum, an American oil company, has announced that it will buy; and Climeworks, a Swiss startup. Both companies are working on facilities in the 100,000-1m-tonnes a year range.

For now, though, the biggest on offer is Climeworks’ Orca, in Iceland. It removes 4,000 tonnes of atmospheric carbon dioxide every year; an Icelandic company called Carbfix then pumps that carbon dioxide down into the island’s basalt to be mineralised. Iceland, being on one of the boundaries where tectonic plates are pulling apart and new crust is being made, has both plentiful fresh basalt and lots of carbon-free hydrothermal power. It hopes that those endowments and some subsequent first-mover advantage will make it a centre for CDR development.

Buy the change you want to be

Early adopters have paid in the range of $1,000 a tonne for carbon dioxide to be removed and stored at Orca. At that price a gigatonne of carbon dioxide is a trillion-dollar proposition; ten gigatonnes a year would represent a tenth of the world economy. And that would not be a capital investment, like the additional $2trn the International Energy Agency sees as being needed to get emissions reduction on track over the current decade. It would largely be an operating expenditure for keeping the planet running.

As Climeworks grows, its prices will presumably drop. Nevertheless, a lot of entrepreneurs motivated by both idealism and ambition think they can do better sooner, and they are beginning to attract investment. BCG reckons that between 2017 and 2022 investment in companies offering durable CDR rose from $28m to $1.1bn. Frontier, a buyers’ club for durable carbon removals, estimates that the number of projects which might offer them such services has now topped 100.

This is in part because a few large companies have stepped up to provide demand. In 2019 Stripe, an online payments company, said it would start paying for durable removals. In 2020 Microsoft started to solicit bids for removals to help it reach its newly announced goal of becoming “carbon negative”.

In 2022 Stripe created Frontier with its fellow tech companies Alphabet, Meta and Shopify and with McKinsey, a consultancy. Like the “advance market commitments” pioneered in vaccine development in the 2000s, Frontier is a means of incentivising R&D by promising to buy its fruits. The companies can then borrow against these “offtakes”. Frontier has purchases agreed with 15 companies, and its members have committed to spending $1bn on removals to be delivered by 2030.

The magic number on which this industry is focused, perhaps fixated, is $100 per tonne of carbon dioxide. A gigatonne of removals becomes $100bn of revenue, a number that both makes much more economic sense as a running cost to be paid for climate stability and sounds like a healthy global business. What is more, it is not much higher than the price some companies are already paying for their carbon-dioxide emissions.

In the EU’s Emissions Trading System companies which emit carbon dioxide at power stations and some sorts of industrial plant—the scheme covers over 11,000—need to surrender allowances to do so. At the moment the market price of these allowances is €80 ($85) a tonne. Prices in other so-called compliance markets are not as high. But in all of them it is assumed that they will rise. And compliance markets cover a quarter of the world’s greenhouse-gas emissions.

This suggests the possibility, somewhere down the road, of a net-zero economy run in a way to delight any free-market economist: for every tonne emitted, the emitter would pay for a tonne to be removed. Rather than being set by governments, the cost of carbon would be a fact of the market, and a signal around which the economy could organise itself with maximum efficiency.

No achievable system will be as simple as that. But if net-zero economies are to be viable, the removals they require will have to be paid for somehow; other things being equal, the greater the role for markets in that system the better. ■

This article appeared in the Special report section of the print edition under the headline "What goes up must come down. Eventually"

From the November 25th 2023 edition

Discover stories from this section and more in the list of contents

Explore the edition