Ten business trends for 2024, and forecasts for 15 industries

A global round-up from The Economist Intelligence Unit

Ten business trends for 2024

1 Central banks including America’s Federal Reserve start to reduce interest rates as price rises slow. With global inflation still at 5%, however, consumers remain thrifty.

2 Amid efforts to slow climate change, renewable-energy consumption climbs by 11% to a new high. But fossil fuels still meet over four-fifths of energy demand.

3 IT spending picks up, rising by about 9%. Artificial intelligence generates remarkable hype but produces precious little revenue and plenty of scrutiny.

4 The gap between the infrastructure the world needs and what it gets amounts to $3trn. To plug its infrastructure hole, Asia’s gross fixed investment expands by 4%.

5 Revenue in the advertising industry increases by 5%, thanks to America’s presidential election and big sporting events such as the Paris Olympics.

6 International tourism rises above geopolitical and economic uncertainty to create record revenue of $1.5trn, fuelled by high prices and post-pandemic wanderlust.

7 A greying world spends vigorously on health. With about one in ten people aged 65 or older, health care makes up one-tenth of global gdp.

8 America shells out $886bn on defence, supporting Ukraine and countering China—whose neighbours, including Japan, Taiwan and the Philippines, also bolster their defences.

9 Electric vehicles speed forth, driven by strong government support. One in four new cars is a plug-in, with more than half of these sold in China.

10 With 60% of America’s firms allowing working from home, a fifth of American offices lie empty. The EU’s less relaxed employers will keep its vacancy rate at just 8%.

Forecasts are for 2024 unless otherwise indicated.

World totals based on 60 countries accounting for over 95% of world GDP

[email protected]

Business environment

Geopolitics will again loom large in 2024, as US-China tensions mount and the wars in Ukraine and Gaza rumble on. Inflation will fall and interest rates level off; supply-chain kinks will ease, along with commodity prices. But global GDP will grow by only 2.2% amid lacklustre expansions in rich countries. Developing economies will do better, though China will lose corporate investment to competitors. Companies will face new environmental rules and perhaps a global minimum tax rate.

Automotive

The car industry will stay in low gear in 2024. Global sales will miss pre-pandemic levels, with just 3% more new cars and 1% more commercial vehicles sold than in 2023. Diesel will fall foul of more low-emission zones, as French cities go off-limits. But electric vehicles (EVs) will speed ahead. Nearly 25% of new cars will be plug-ins, over half sold in China. The barely profitable market for EVs will still rely on government support. Chinese carmakers will benefit from extended tax breaks (and rising exports). American buyers will be able to transfer tax credits for EVs to dealers, lowering sticker prices. Britain’s carmakers must make plug-ins 22% of sales and pay post-Brexit tariffs if vehicles do not use enough locally made parts.

Similar content rules will rankle widely, as America, China, Japan and the EU compete for investment in EV and battery production. America will gain from the $108bn or so promised towards this end, nearly doubling its battery capacity. Renault intends to list its electrics business, Ampere, with its partner, Nissan, taking a stake. Tesla-type chargers will vie with European and Chinese ones, as network standards diverge. Autonomous driving will get new rules in the EU as well as a federal regulator in Washington.

TO WATCH: Better batteries. Lithium-ion batteries will encounter new challengers in 2024, including Gotion’s lithium- manganese-iron-phosphate batteries and BYD’s cheaper sodium-ion ones. Revolutionary solid-state batteries may take longer: China’s SAIC says they will be ready in 2024 but Toyota and others are targeting 2027.

Defence and aerospace

As Ukraine fights on and US-China relations fester, military powers will increase defence budgets. Around a third of NATO members are expected to hit a long-standing target of spending over 2% of GDP on defence—a welcome 75th-birthday present for the alliance. Finland, a new recruit to NATO, will be among them. Britain and Poland will stay nicely on target but France will record a near miss. Sweden, another new joiner, will also fall short.

America, the world’s biggest defence spender, will shell out around $886bn. Some $13bn will go to Ukraine, adding to the $45bn sent so far. Further outlays will equip America’s air force with new-generation fighters. Uncle Sam’s spree will attract venture capital into high-tech military startups and bolster space defence, as Americans revisit the Moon (in a fly-by) after a 52-year hiatus. America’s total defence budget, however, will grow by just 3%, trailing both inflation and typical Chinese increases of around 7%.

Fear of China will boost defence spending in Asia. The Philippines plans a double-digit hike, Japan a record-high budget. Taiwan will extend compulsory military service and develop anti-drone defences. India, still the biggest buyer of Russian weaponry, will hedge its bets with orders from Western countries. China’s weapons-makers will benefit from a spending surge in Pakistan. And America, China and Japan will speed ahead with efforts to develop and detect hypersonic missiles, as Russia deploys them more widely.

Energy

Although renewable-energy use will rise by 11% to a new high, fossil fuels will meet around 80% of energy demand in 2024. Oil consumption will grow by 1% as economies recover. But higher output in Saudi Arabia and America will keep oil prices below $85 a barrel. Coal and gas use will edge up, too, despite investors’ doubts about coal. Britain and perhaps Italy will close their coal-fired power plants, but Asia’s craving for the dirty stuff will intensify.

Burning fuel will produce 70% more carbon emissions in 2024 than in 1990, defying clean-energy aims. Britain’s net-zero target will apply emissions cuts on companies there. The EU will provide subsidies under its Green Deal. America will aim for energy savings, China for less carbon-intensive growth.

Wind and solar consumption will reach twice 2019’s level, boosted by America’s Inflation Reduction Act and the REPowerEU plan. The cost of producing renewable energy will fall, but will still be 10-15% above 2020 levels. At least 11 nuclear reactors will open, including in new adopters such as Bangladesh and Turkey. Hydrogen investment is climbing in Germany, Jordan and elsewhere. Even so, nuclear and renewables together will provide less than 20% of all energy. One barrier will be climate change itself, as droughts stem the flow of hydropower.

Financial services

Interest-rate rises will stall in 2024 and many banks’ profits will slip. Narrowing net-interest income and hits on commercial-property portfolios will hurt American lenders. Most EU banks will see bad loans fall after a tough 2023 and reduce their reliance on the central bank by issuing debt. Asian banks will record stronger growth as China extends support for its troubled property market.

The number of bank branches and cash machines will decline further amid a shift to digital banking. EU banks will contemplate bank stablecoins and Brazilian banks will back a digital real. Even so, the shake-out in fintech is not over, with many investors demanding profitability from startups. Equity markets will prosper, thanks to buoyant emerging markets and tech stocks. London will resist EU attempts to wrest away share trading; in Asian finance, India will gain ground.

Regulations will tighten across finance. Implementation of Basel III banking-risk rules will enter its final phase in two-thirds of countries. America will raise bank-capital requirements. Insurers, too, will face new capital rules—and mounting climate claims.

TO WATCH: Financial environment. Climate reporting will heat up in 2024. The International Sustainability Standards Board will roll out two global standards for environmental, social and governance (ESG) risks, vying with stricter EU rules and possibly looser American ones.

Food and farming

Economist Intelligence, a sister company of The Economist, predicts that declining fuel and fertiliser prices, and good harvests in 2024, will push down its index of agricultural prices for a second year running. But there are plenty of risks to this forecast—and to the world’s food supplies. War and bad weather will inflict hunger on more than 345m people. Uncertainty is rife in the Black Sea food belt: a Russian blockade of Ukraine’s grain exports could endanger global supplies. The El Niño phenomenon, caused by warmer waters in the Pacific ocean, will produce erratic weather that could cost the world economy $3trn. Although El Niño should recede by mid-2024, it threatens to cut crop yields in Africa, Asia and Central America.

Governments will respond to such problems with subsidies and price controls—India, a big food producer, has curbed exports of rice and sugar. Healthy eating will be back in vogue. Canada will discuss limits on junk-food ads. Poland plans to ban energy-drink sales to minors. Even developing countries such as Colombia and the Philippines will increase tariffs on sugary drinks and processed food.

TO WATCH: Powder power. In 2024 a Finnish firm, Solar Foods, will manufacture a protein powder using gas fermentation to feed microbes. Made without photosynthesis, Solein can supposedly satisfy a person’s amino-acid needs. The product, already approved in Singapore, could help counter an impending shortage of protein.

Health care

Money will not cure all ills for the health-care industry in 2024. Health spending, still boosted by the pandemic and inflation, will grab more than 10% of global GDP but Nigerians’ life expectancy will remain 30 years below Hong Kongers’. Even so, 10% of humanity will be 65 or older. Developed countries with ageing populations will compete for health workers. Many more medical staff will suffer burnout; some will quit.

Governments will try to fill the gaps. Nearly 80% of spending will come from public sources such as tax or compulsory insurance, up from 75% before covid. Egypt will extend its universal health-insurance plan to more cities; Slovenia will prepare a long-term care plan. India will struggle to raise health spending before elections. America will concentrate on cost-cutting and ending or defending abortion rights, depending on the state. Private care will see patchy growth: Amazon and Walmart will roll out new clinics but CVS Health will cut staff.

Global pharmaceutical sales will surpass $1.6trn, with America swallowing over a third and China a tenth. Patent expiries are mounting. In 2024 medicines worth $38bn in sales, including many biotech drugs, will meet competition from cheaper generics. Researchers will battle over mRNA patents, as trials of anti-obesity drugs bulk up. The pandemic will be nearly gone, but not forgotten: a draft global accord will help prepare for the next one.

TO WATCH: Defining death. To determine a person has died, some jurisdictions focus on expiry of the brain stem, crucial to bodily functioning. Others insist all brain activity must cease. Reforms to America’s Uniform Determination of Death Act, due in mid-2024, aim to iron out such differences—scant comfort to families and doctors deciding when to cut life support.

Infrastructure

Improving America’s ageing infrastructure may not be voters’ top priority when choosing a president. Joe Biden will nonetheless boast of his efforts to reboot power and transport. Rewards could be slow to arrive, however. America’s gross fixed investment, a proxy for infrastructure spending, will rise by less than 1% in real terms in 2024, versus 2.7% worldwide. At that rate, the gap between America’s infrastructure spending and its needs will hit $2.6trn in the decade to 2029, or $260bn a year.

Asia’s gap is bigger, at $459bn a year, within a global total of $3trn. But Asian gross fixed investment will climb by a brisk 4% in 2024. Indonesia alone will allocate $28bn, splashing out on a new capital. China will focus on digital infrastructure and waste disposal. Germany will lead the EU’s 1% investment growth, pouring $61bn into green infrastructure.

Investment in solar and wind, much of it in China, will set global records. Fearful of power plays by Moscow, the Baltic countries will unlink their grids from Russia’s to join them with central Europe’s. Tesla and other carmakers will build out charging networks. India will lay highways, its investment matching car-mad America’s.

TO WATCH: Belt or brace? After more than a decade, China’s Belt and Road Initiative (BRI) needs a reboot. Investment in Africa has fallen, Pakistan is debt-laden and Italy wants to quit. In 2024 China will again be the second-largest source of foreign direct investment after America. But it will vet BRI projects more carefully—and look to the BRICS for influence.

Information technology

After a slow couple of years, global IT spending will pick up in 2024, growing by almost 9%, according to Gartner, a consultancy. Spending on hardware will climb again. Shipments of personal computers will rebound to 261m—still below 2019’s tally. Artificial intelligence (AI) will be the buzziest of tech buzzwords. Businesses will look to AI and other new technologies to enhance productivity, cut costs and manage risks. But AI will not generate as much revenue as advocates hope.

The EU will reinforce its status as the default global tech regulator when the Digital Markets Act enters into full force in 2024. AI-specific legislation will be gestating, and regulators will try to impose checks on the bots. Algorithms will fuel worries about disinformation and cyber-security, and EU regulators will again respond with gusto. By October, the bloc’s members must comply with a directive to fend off cyber-miscreants. Meanwhile, the European Central Bank will stress-test top banks’ cyber-resilience amid uncertain economic times.

Technological advances will stimulate demand for more advanced semiconductors, even as supply gluts affect things like memory chips (mainly used in consumer electronics). Western governments will dangle subsidies to lure semiconductor manufacturers to their shores and combat China’s dominance. But expect headlines about labour shortages and delayed factory openings. One noteworthy postponement is the launch of TSMC’s first American chipmaking plant, originally slated for 2024 but now down for 2025. Re-engineering supply chains for geopolitical ends could make technological innovation itself look easy.

Media and entertainment

Hopes are high that global advertising revenue will bounce back after a disappointing 2023. Dentsu, a media giant, forecasts an expansion of almost 5% in 2024, to $762.5bn: thank America’s presidential election, the Paris Olympics and football’s Euro 2024 tournament. Digital advertising will make up almost half of this spending. Magnifying this will be retailers’ efforts to sell slots for electronic ads displayed in their stores and on their websites, in the hope of offsetting a slowdown in consumer spending.

As digital ads surge, privacy worries will intensify. In 2024 Google will at last follow Apple’s lead in blocking third-party cookies. But regulators will direct their ire towards Google’s digital-ad dominance. Even as trouble brews in the EU, a federal antitrust case—the second against Google in recent years—will reach America’s courts. Though American officials often favour self-regulation, they may also intervene to restrict the use of AI in political advertising during an election year, aiming to stem the spread of disinformation.

AI-generated content will trouble Hollywood, too. Concerns about competition with the bots helped ignite strikes by writers and actors. Their flounce-outs could delay the release of possible blockbusters such as “Mission Impossible: Dead Reckoning Part Two” (in which Tom Cruise battles an evil AI). This may hamper the return of America’s box-office revenues to their pre-covid bounciness. As for streaming services, cinemas’ arch-rivals, they will struggle to boost subscriptions. Disney+, keen to increase take-up, will stop subscribers sharing passwords, mimicking Netflix. It will take over Hulu, another streamer, under an agreement from 2019. Whether this affords Disney+ a fairy-tale ending—finally turning a profit—remains to be seen.

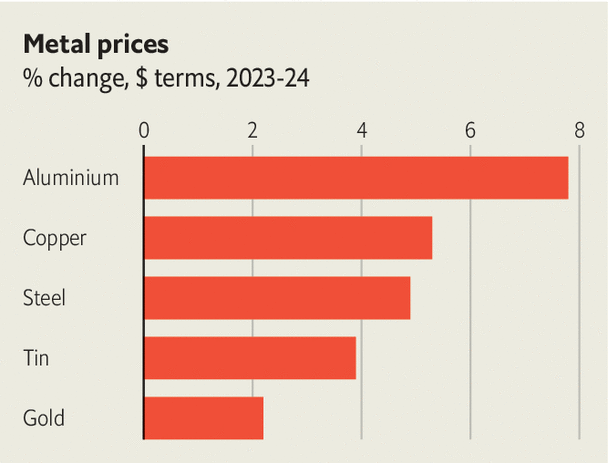

Metals and mining

Though many farm commodity prices will fall in 2024, most metals will get pricier. Copper will shine as green investment and the digital economy spur demand for electric cables and batteries. Aluminium prices will be driven up by Asian construction firms and carmakers. Steel prices will also climb but remain 36% below their peak in 2021. Gold and platinum will gleam as investors seek safe havens and interest-rate rises stall.

Not every metal will glow. Nickel and zinc peaked in 2022; galloping Indonesian and Chinese production will now suppress prices. Lead will be weighed down by the shift away from petrol and diesel vehicles. Lithium markets could reach surplus as Zimbabwe, which has large reserves, and others ramp up output. Coal prices will soften as the Russia-induced energy crisis recedes. Steel and aluminium producers will face new fees under the EU’s carbon border-adjustment mechanism.

Europe and America will try to stop China dominating the processing of critical minerals needed for clean energy. That could mean investing in mines everywhere from Australia to Chile. Angola and Botswana will team up to extract diamonds; the privatisation of Angola’s diamond producer may help.

TO WATCH: Mine, mine, mine. The UN’s International Seabed Authority is letting companies bid for licences to mine the seabed—even before finalising rules to govern their activities. Canada, Norway, Japan and South Korea are among countries keen to start exploring for critical minerals in 2024, ignoring howls of protest from environmentalists.

Property

Investors in commercial property face a reckoning in 2024 as high interest rates, lease expiries and changed working patterns dent demand. With roughly 60% of American companies allowing working from home, a fifth of offices will stand empty—a new peak. Office-vacancy rates will rise to 15% in Canada but just 8% in the EU, which has less hybrid working. China’s property market (and regional finances) will stay wobbly, despite government support. The rest of Asia will see a fitful rebound.

A slowdown in supply will support prices in some places, however, as projects are delayed or cancelled. Core business districts will be fuller, and greener buildings more popular. Warehousing and factory demand will recover. Health-care property and data centres will be in vogue. In late 2024, as interest rates start falling, investors will return to property. Britain will try to attract real-estate investment trusts; several Indian REITs will go public. China’s property woes will send buyers to Dubai or Australia.

Some obsolete offices and shops will be converted to housing as regulations ease. Even so, high mortgage rates and scarce new housing will make property hunting hard. House prices, inflated by covid, will fall in much of Europe but stay high in America. Buyers will find it cheaper to rent in America but not in London, despite government efforts to improve renters’ rights. Some cities will add new limits on short-term letting.

Retail

Fading inflation will cause retail sales to rise by 2% in real terms in 2024, about twice as fast as in 2023. But consumers will not readily shrug off high interest rates, reduced household savings and rising credit-card defaults. Thus Western retail markets will be soft again. After two years of contraction, Britain and Germany will be slow to recover. America will suffer another sluggish year.

Even China, the world’s second-largest retail market, will grow by just 4%, compared with 7% on average before covid. Blame the shaky Chinese property market and a paucity of jobs for the young. Retailers eager to tap Asian consumers will look to South-East Asia, where Malaysia, Thailand and Vietnam will be among the zippiest growers. Helping this along will be the spread in developing countries of a pandemic-induced boom in e-commerce. The fastest rate of online-sales growth will be in India, where policymakers are pushing hard to promote financial technologies, or fintech, and other forms of digitalisation.

TO WATCH: Aldi but goodie. As more bricks-and-mortar chains scale back or close, one “old-fashioned” retailer will buck the trend. Aldi, a German supermarket chain, will expand aggressively. In the first half of 2024, it should close a deal to buy 400 shops in America’s south-east. For now, Aldi’s share of the American grocery market is just 2%. But it hopes its cheap private-label brands will win over inflation-battered shoppers.

Sport

Paris will host the Olympics for a third time in the summer of 2024, a century after its last games. After an opening ceremony on the River Seine, the Olympic and Paralympic events will tour France’s landmarks, with dressage at Versailles and blind football at the Eiffel Tower. Breakdancing will make its Olympic debut on the Place de la Concorde, while surfing will rock up in Tahiti. Tighter regulation of rental sites will not stop Parisians renting out their homes to more than 1m expected visitors.

Other sporting events will compete for attention. The Euro 2024 football tournament will kick off in Germany in June, six weeks before the Paris games. But the African Games in Ghana, postponed for a year, will compete head-on with the Olympics in August. The Copa America will head to the United States after Ecuador withdrew as host for security reasons. The Africa Cup of Nations will take place in Ivory Coast, and the America’s Cup will set sail for the Spanish coast off Barcelona.

Women’s events will gain traction. Cyclists will pedal the Le Tour de France Femmes for the third time. And while America will hold its first cricketing World Cup —the T20 for men—Bangladesh will host the women’s version. This will include a transgender player for the first time. Contrast that with the Olympics, where trans women with high testosterone are banned.

Telecoms

In 2024 5G will overtake 4G to become the dominant mobile technology in China, says the GSMA, an industry body. But 5G adoption will touch only 20% globally. Ericsson, which builds telecoms infrastructure, expects a quarter of the world’s population still to lack mobile-broadband access in 2024.

Help will arrive from above. After aiding Ukrainian efforts to stay connected during the war, Elon Musk hopes to gain approval to expand coverage of Starlink, his satellite-internet service, to Indonesia in 2024. That would improve access and transfer speeds in a country with one of Asia’s worst internet-penetration rates. Another tech billionaire, Jeff Bezos, backs Project Kuiper, which plans to put its first commercial satellites in space in 2024. Not all governments are happy to acquiesce in American dominance of the skies: China, the EU and Russia will launch satellites of their own. The spread of internet connectivity should help pull the global smartphone market out of a funk—just about. Samsung and Apple will remain the biggest smartphone companies, but China’s Transsion (owner of the Tecno, itel and Infinix brands) will break into the top five, says IDC, a market-research firm.

TO WATCH: Reality check. Vision Pro, Apple’s augmented- and virtual-reality headset, will at last go on sale in 2024. At $3,499, it will be pricier than Meta’s competing product, the Quest 3, which costs $499. But Apple is expected to launch cheaper versions in future.

Travel and tourism

The travel industry hopes for brighter times in 2024—without too much sun. To avoid wildfires and record heat, more child-free travellers will spurn summer trips. Airlines will alter schedules to match. International tourism arrivals, at 1.8bn, will rise, almost back to 2019 levels, despite the caution of Chinese travellers amid geopolitical and economic worries in many parts of the world.

Even so, international tourism spending will hit a record $1.5trn, spurred by loftier prices. Add in domestic flights, and air travel will reach pre-pandemic heights. Profits will stay aloft. Aerospace companies will struggle with order backlogs, but provide airlines with a soaring number (1,484) of new planes—among them Airbus’s new narrow-body A321XLR, able to fly 8,700km non-stop. Air New Zealand will offer sleep pods in economy class. Travellers seeking novelty might visit the world’s tallest hotel, in Dubai, or a 3D-printed hotel in Texas. Still, higher prices will cut hotel occupancy rates.

TO WATCH: Waiving hello. From late 2024 visa-free travellers to the EU’s Schengen zone will have to prebook a €7 ($8) ETIAS visa waiver, valid for three years. The aim is to capture data to improve security. But the charge will apply to 1.4bn potential travellers from 60 countries—a big headache for tourists.

This article appeared in the The world in numbers section of the print edition of The World Ahead 2024 under the headline “Industries”