Will America manage a soft landing in 2024?

Policymakers rarely bring down inflation without a recession. This time they might

Could 2024 be a year unlike any in America’s post-war economic history? Never since 1945 has annual inflation, measured by the consumer-price index, fallen from above 5% to below 3% without a recession at the time of the fall or within the subsequent 18 months.

Yet professional forecasters surveyed by the Federal Reserve Bank of Philadelphia say that at the end of 2024 headline annual inflation will be 2.5%, whereas real GDP will grow by 1.7% over the course of the year—roughly in line with its long-term trend. Financial markets are rejoicing at the prospect of such a “soft landing”.

The Fed has been fighting inflation by raising interest rates since March 2022. Monetary tightening usually provokes a recession because disinflating an economy is much like disinflating a balloon: it is hard to do gently. There have been instances where rate rises have not led to a downturn, such as in the mid-1980s and late 1990s (and other times where events, such as the covid-19 pandemic, interjected). But on those occasions inflation had not reached anything like the highs it did in 2022. That the Fed raised interest rates so fast in 2022 and 2023 would make a soft landing all the more exceptional.

When would it become clear that the economy had landed? Inflation data are revised less than other economic data, so the Fed hitting its target would probably happen in plain sight. Given how rare it is for inflation to stand at precisely 2%, it would be fair to declare the goal met should both annual headline and annual core inflation, which excludes volatile food and energy prices, fall beneath 2.5% on the Fed’s preferred price index, which rises a little slower than the CPI.

In the past three months America’s core inflation has risen at an annualised pace of just 2.2%. Should that continue, the annual measure would fall below 2.5% in February. Without, say, an oil-price surge, headline inflation would probably also be at target.

The other criterion for a soft landing—dodging a downturn—is harder to judge. Recessions tend only to be declared long after they have struck. In the past, the most reliable real-time indicator that one is beginning has been the “Sahm rule”. It is triggered when the three-month moving average of the unemployment rate rises by 0.5 percentage points against its low over the preceding year. The rule has identified every American recession since 1960, with no false positives. Today unemployment is up by 0.3 percentage points from its mid-2023 low.

The Sahm rule could break down this time, as labour markets have been exceptionally tight since the pandemic. It would be only natural for the unemployment rate to rise a little. Claudia Sahm, who invented the rule, has warned that it is distorted by the return to the labour force of people who left during the pandemic, something that pushes up the unemployment rate even in the absence of layoffs.

But in that case the rule will deliver an incorrect recession call, rather than missing a downturn. If the Fed hits its inflation target without the Sahm rule being triggered, it would therefore be safe to declare the plane had touched down.

It would not, however, have come to a stop. In the early 1950s and the early 1970s, recessions struck nearly a full year and a half after inflation fell. Nor would policymakers have finished adjusting the controls. At its December meeting the Fed signalled that it expected to cut interest rates by three quarters of a percentage point in 2024.

It wants to loosen monetary policy in part because it believes that the natural resting-point of interest rates is lower than their current level. If the Fed is wrong, interest-rate cuts will act as an undue stimulus and inflation will reaccelerate. Fiscal policy will also still look on a crisis setting, given America’s enormous underlying deficit, which reached 7.5% of GDP during the 2023 fiscal year. Cutting that significantly could hurt.

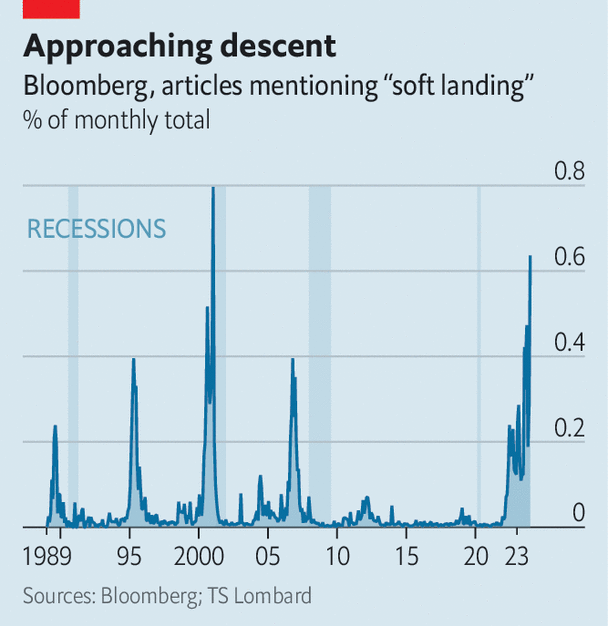

The other reason for caution is that talk of a soft landing often occurs just before recession strikes (see chart). And that is in normal business cycles. Since the pandemic forecasters have performed poorly, underestimating growth and, until recently, inflation. That they now think a soft landing is arriving is good news. But don’t believe it until you see it. ■

Explore more

More from Finance and economics

How to get rich in the 21st century

The race to become the next economic superpower

The five biggest market surprises of 2023

Shareholders have had a remarkably good year. Forecasters have had a terrible one

Hong Kong’s problems trace back to China. And also America

The “superconnector” suffers the worst of both worlds