Who was the best CEO of 2023?

We measure up the business world’s top dogs

It has been a tricky year atop the corporate ladder. Sluggish growth in many markets has set bosses scrambling to rein in costs just as inflation has spurred their workers to demand hefty pay rises. Fractious geopolitics and toxic culture wars have left corporate chieftains feeling like tightrope-walkers. The craze for generative artificial intelligence (AI) has had them fretting over looming technological disruption, too.

Still, for some chief executives 2023 was a vintage year. To determine who did it best, The Economist has examined the performance of bosses of large listed companies in the S&P 1200 index, which covers most big economies bar China and India. We put aside those who have been in the job for less than three years, to avoid giving too much credit for replacing an inept predecessor. We then ranked the remaining chief executives by the returns they generated for shareholders relative to their sector’s average. The top ten by that measure included both household names and relative dark horses.

Among the top ten were bosses of two companies—Cameco, a Canadian miner, and PulteGroup, an American homebuilder—whose stellar results were thanks mostly to macroeconomic forces (a surge in uranium prices and a slump in sales of existing homes, respectively). We left them out. Also on the list were the chief executives of two buy-out firms, 3i and Melrose Industries, whose results were more a testament to the performance of the bosses running their portfolio companies than the financiers on top. We excluded them, too. Last, we also removed Richard Blickman of BE Semiconductor Industries, a Dutch maker of chipmaking tools. His pay was rejected by shareholders—not a good look for any chief executive.

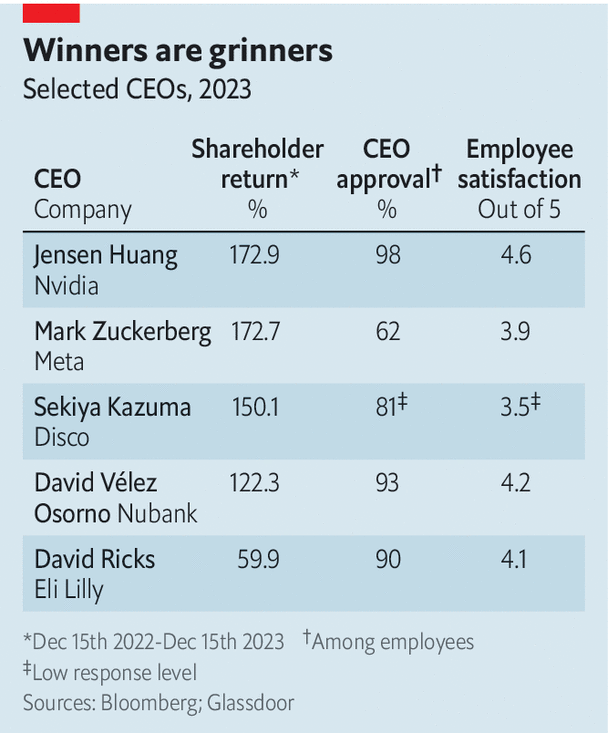

That has left us with a shortlist of five superstar chief executives for 2023 (see table). In ascending order of shareholder returns these are: David Ricks of Eli Lilly, now the world’s most valuable pharmaceutical firm; David Vélez Osorno of Nubank, a Brazilian neobank that is gobbling up customers across Latin America; Sekiya Kazuma of Disco, a Japanese maker of cutting-edge tools for semiconductor production; Mark Zuckerberg of social-media giant Meta; and Jensen Huang of Nvidia, a chipmaker whose market value soared past $1trn this year.

Over the holiday season all five can bask in the warm glow of having generated enormous value for shareholders. But who has had the best year of all?

A case can be made for any of the five. Mr Ricks has put Eli Lilly close on the heels of Novo Nordisk, a Danish rival, in the bulging market for anti-obesity drugs and overseen extraordinary results in a very ordinary year for the industry. Few neobanks have managed to dislodge entrenched incumbents. Yet under Mr Vélez’s leadership Nubank, which he co-founded in 2013, has grown into the fifth-largest financial institution in Latin America by number of customers. Mr Kazuma, who also runs Disco’s research-and-development division, has kept his company at the frontier of semiconductor dicing and grinding for many years. After terrifying investors in 2022 with his descent into metaverse madness, Mr Zuckerberg delighted them in 2023 with his “year of efficiency” and his company’s forays into generative AI. And Mr Huang has cemented his firm’s position as the indispensable supplier of the chips powering the AI revolution.

How, then, to choose? One way is to listen to the underlings. After all, a chief executive that hoists the share price but enrages staff is unlikely to succeed for long. We gathered figures from Glassdoor, an employee-review website, on how workers at the five companies felt about their chief executives and their companies more broadly.

At a mere 62% Mr Zuckerberg’s approval rating is a clear outlier, suggesting that his “year of efficiency” has been as awful as it sounds for employees. Worker satisfaction at Disco also seems low (albeit with fewer respondents). One explanation may be the company’s odd mechanism for co-ordinating work. Teams use a virtual currency called Will to pay one another for providing services. Managers then dole out the currency among team members for performing tasks, which determines bonuses. All that sounds like an economist’s dream, but hardly collegial.

Angering customers is also an unsound strategy for chief executives. This year a number of American states including California have sued Eli Lilly, among others, for allegedly overcharging for insulin, an essential drug for diabetics. The company’s decision in March to slash insulin prices by 70% has done little to quell the upset. (The company has rejected what it describes as the “false allegations” of the lawsuit in California.)

As for Mr Vélez, not all of his strategy is paying off. Although Nubank is profitable as a whole, an achievement that has eluded many of its peers elsewhere, it is losing money in Mexico, where its approach of targeting the unbanked is proving costly. If Mr Vélez pulls it off, he could claim the prize in years to come.

It is Mr Huang, then, who prevails. Few bosses have been as farsighted in their bets on AI as Nvidia’s chief. Over a decade ago Mr Huang realised that the graphical processing units his company produced were also good at training AI models. In the years that followed he readied Nvidia for the AI wave by investing in a proprietary software platform, CUDA, to help developers make use of its chips and by acquiring Mellanox, a supplier of networking technology that links many chips together to deliver greater processing power. The pay-off from those bets is now becoming clear; Nvidia controls over 80% of the market for specialist AI chips.

Mr Huang, whose signature leather jacket has become as integral to his public persona as the turtlenecks sported by Steve Jobs, reportedly shares the Apple founder’s intensity and exacting standards. Nonetheless, he is adored by staff, with a 98% approval rating. All things considered, he has had the best 2023 of all. ■

Explore more

More from Business

A new-year message from the CEO

Up the permavucalution!

Welcome to the era of AI nationalism

Sovereigns the world over are racing to control their technological destinies

China is shoring up the great firewall for the AI age

The Communist Party has created a thriving but sanitised digital economy. Can it do the same with artificial intelligence?